Print Business Tax Receipt

Introduction

Hello Readers,

Welcome to this informative article on print business tax receipt. In today’s fast-paced and evolving world, it is crucial for businesses to stay compliant with tax regulations. One essential aspect of this compliance is obtaining a business tax receipt. In this article, we will delve into the details of print business tax receipt, including what it is, who needs it, when and where to obtain it, why it is important, and how to go about the process.

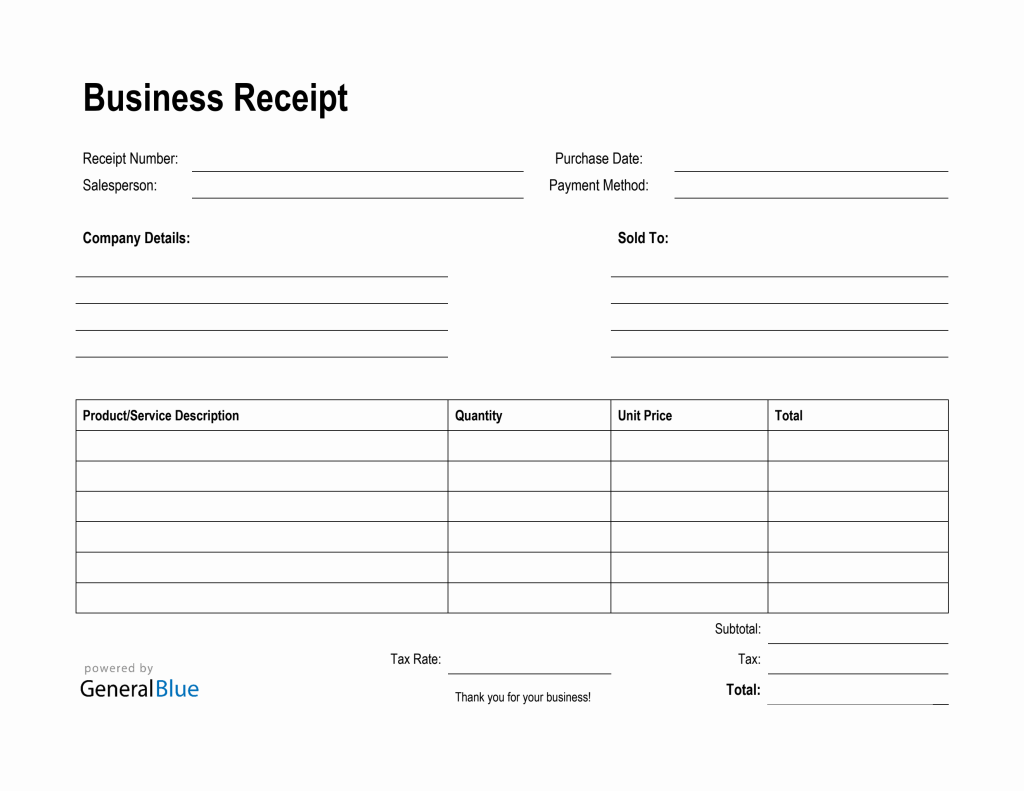

Image Source: generalblue.com

Now, let’s explore the comprehensive information about print business tax receipt.

What is a Print Business Tax Receipt?

📜 A print business tax receipt, also known as a business license or occupational license, is an official document issued by the local government or municipality that grants permission for a business to operate legally within a specific jurisdiction.

📜 The receipt serves as evidence that the business has paid the necessary taxes and fees to operate in compliance with local regulations.

Image Source: allbusinesstemplates.com

📜 It typically contains information such as the business name, type of business, address, owner’s name, and the validity period of the license.

📜 This document not only allows businesses to operate legally but also provides credibility and assurance to customers, suppliers, and partners that the business is legitimate and trustworthy.

📜 Depending on the location, there may be different names for the document, such as a business tax certificate, business permit, or tax registration certificate.

📜 It is important to understand the specific requirements and regulations of the jurisdiction where the business operates to determine if a print business tax receipt is necessary.

Who Needs a Print Business Tax Receipt?

👥 Any individual or entity engaging in business activities within a specific jurisdiction may need a print business tax receipt.

👥 This includes sole proprietors, partnerships, corporations, and even freelancers or independent contractors operating on a self-employed basis.

👥 The requirement for a print business tax receipt can vary depending on the nature of the business, location, and local regulations.

👥 It is crucial to consult with the local government or municipality to determine the specific requirements and obligations for obtaining a print business tax receipt.

👥 Failing to obtain the necessary licenses and permits can result in penalties, fines, and even legal consequences.

👥 It is always better to ensure compliance and operate a business legally to avoid any potential issues in the future.

👥 Additionally, having a print business tax receipt can enhance the professional image and reputation of the business.

When and Where to Obtain a Print Business Tax Receipt?

📅 The timing and process of obtaining a print business tax receipt can vary depending on the jurisdiction and local regulations.

📅 Typically, the application process takes place before starting the business operations or within a specific timeframe defined by the local government.

📅 The local government offices, such as the city hall or county administration, are usually responsible for issuing print business tax receipts.

📅 The exact location and specific requirements can be obtained by contacting the relevant authorities or visiting their official websites.

📅 It is recommended to start the application process well in advance to allow for any potential delays or additional documentation required.

📅 Some jurisdictions may also allow online applications and payments, streamlining the process for business owners.

📅 Once the application is submitted, it will undergo review and verification by the appropriate authorities, and upon approval, the print business tax receipt will be issued.

Why is a Print Business Tax Receipt Important?

❗ A print business tax receipt is an essential document that demonstrates compliance with local tax regulations.

❗ It provides legal permission to operate a business within a specific jurisdiction.

❗ Having a print business tax receipt enhances the credibility and trustworthiness of the business in the eyes of customers, suppliers, and partners.

❗ It ensures that the business is contributing its fair share to the local economy through taxes and fees.

❗ Operating without a valid print business tax receipt can result in penalties, fines, and legal consequences.

❗ Additionally, some customers and organizations may only engage in business with entities that possess the necessary licenses and permits.

❗ Overall, a print business tax receipt is crucial for establishing a legitimate and compliant business presence.

How to Obtain a Print Business Tax Receipt?

📝 The process of obtaining a print business tax receipt can vary depending on the jurisdiction, but here are some general steps:

📝 Research the local regulations and requirements for obtaining a print business tax receipt.

📝 Gather all the necessary documentation, such as proof of identity, proof of business ownership, and any additional permits or licenses required.

📝 Complete the application form provided by the local government or municipality.

📝 Pay the required fees and taxes associated with the print business tax receipt.

📝 Submit the application along with the supporting documents and payment.

📝 Wait for the application to be reviewed and processed by the relevant authorities.

📝 Upon approval, collect the print business tax receipt.

📝 Display the receipt prominently at the business premises as required by local regulations.

📝 Ensure to renew the print business tax receipt within the designated validity period to avoid any disruptions in business operations.

Advantages and Disadvantages of Print Business Tax Receipt

Advantages

✅ Provides legal permission to operate a business within a specific jurisdiction.

✅ Enhances credibility and trustworthiness in the eyes of customers, suppliers, and partners.

✅ Demonstrates compliance with local tax regulations.

✅ Ensures the business is contributing its fair share to the local economy.

✅ Establishes a legitimate and compliant business presence.

Disadvantages

❌ Involves additional costs and fees.

❌ Requires time and effort to complete the application process.

❌ Failure to comply can result in penalties, fines, and legal consequences.

❌ Additional permits or licenses may be required depending on the nature of the business.

❌ Some jurisdictions may have complex or changing regulations, making the process more challenging.

Frequently Asked Questions (FAQ)

1. Do all businesses need a print business tax receipt?

Not all businesses may require a print business tax receipt. The necessity depends on the specific jurisdiction and local regulations. It is important to research and consult with the local government or municipality to determine the requirements for your business.

2. Can a print business tax receipt be transferred between owners?

In most cases, a print business tax receipt cannot be transferred between owners. When a change in ownership occurs, a new application and review process may be necessary to issue a new print business tax receipt under the new owner’s name.

3. What happens if a business operates without a print business tax receipt?

Operating without a valid print business tax receipt can result in penalties, fines, and legal consequences. It is essential to obtain the necessary licenses and permits to ensure compliance with local regulations and avoid any potential issues.

4. Can a print business tax receipt be renewed automatically?

The renewal process for a print business tax receipt varies depending on the jurisdiction. Some jurisdictions may offer automatic renewals, while others may require business owners to submit a renewal application within a specific timeframe. It is crucial to familiarize yourself with the renewal process defined by the local government.

5. Are there any exemptions from obtaining a print business tax receipt?

Some jurisdictions may offer exemptions or reduced fees for certain types of businesses, such as non-profit organizations or small-scale enterprises. However, the specific exemptions and eligibility criteria may vary. It is advisable to inquire with the local government or municipality to determine if any exemptions apply to your business.

Conclusion

In conclusion, a print business tax receipt is a vital document for businesses to operate legally and demonstrate compliance with local tax regulations. It provides legal permission, enhances credibility, and ensures fair contribution to the local economy. Obtaining a print business tax receipt involves understanding the requirements, completing the application process, and paying the necessary fees. It is essential to renew the receipt within the designated validity period to maintain compliance. By obtaining and maintaining a valid print business tax receipt, businesses can establish a legitimate and trustworthy presence in their respective jurisdictions.

Thank you for reading this article. If you have any further questions or require additional information, feel free to reach out. Best of luck with your business endeavors!

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as legal, financial, or professional advice. Each jurisdiction may have specific regulations and requirements regarding print business tax receipts. It is advisable to consult with relevant professionals and the local government or municipality to ensure compliance with the applicable laws and regulations.