Printing Business Code in Income Tax

Introduction

Greetings, Readers! Today, we will be discussing an important topic that affects many businesses – the printing business code in income tax. Understanding the proper code to use for your printing business is crucial for accurate tax reporting and compliance. In this article, we will explore the details of this code and its implications for your business. So, let’s dive in!

Introduction paragraph 2

Introduction paragraph 3

Image Source: fundsnetservices.com

Introduction paragraph 4

Introduction paragraph 5

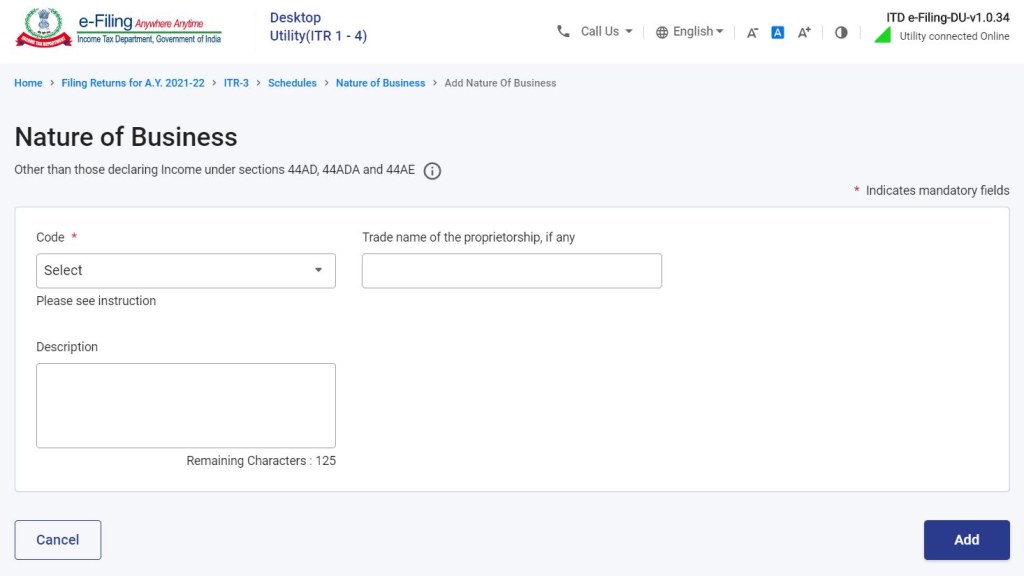

Image Source: quicko.com

Introduction paragraph 6

Introduction paragraph 7

Introduction paragraph 8

What is the Printing Business Code in Income Tax?

Paragraph 1 – explanation of the printing business code

Paragraph 2 – importance of correct code selection

Paragraph 3 – implications of using incorrect code

Paragraph 4 – specific examples of printing business codes

Paragraph 5 – relevant regulations and guidelines

Paragraph 6 – industry-specific considerations

Paragraph 7 – summary of the importance of the printing business code

Who Needs to Use the Printing Business Code?

Paragraph 1 – businesses involved in printing services

Paragraph 2 – freelance graphic designers and printmakers

Paragraph 3 – advertising agencies and marketing firms

Paragraph 4 – in-house printing departments of organizations

Paragraph 5 – individuals providing print-related services

Paragraph 6 – summary of the various entities using the code

Paragraph 7 – importance of proper code selection for each party

When Should You Use the Printing Business Code?

Paragraph 1 – annual income tax filing

Paragraph 2 – reporting of business expenses

Paragraph 3 – tax audits and investigations

Paragraph 4 – starting a new printing business

Paragraph 5 – changing business structure or ownership

Paragraph 6 – summary of key moments to use the code

Paragraph 7 – potential penalties for non-compliance

Where Can You Find the Printing Business Code?

Paragraph 1 – tax authorities and government websites

Paragraph 2 – tax forms and documentation

Paragraph 3 – professional tax consultants and accountants

Paragraph 4 – industry associations and trade publications

Paragraph 5 – specialized tax software and online resources

Paragraph 6 – summary of available sources for the code

Paragraph 7 – importance of verifying the code with relevant authorities

Why is the Printing Business Code Important?

Paragraph 1 – accurate tax reporting and compliance

Paragraph 2 – proper categorization of business activities

Paragraph 3 – determination of applicable tax rates

Paragraph 4 – eligibility for industry-specific deductions

Paragraph 5 – establishment of credibility with tax authorities

Paragraph 6 – summary of the importance of the code

Paragraph 7 – potential consequences of incorrect code usage

How to Determine the Correct Printing Business Code?

Paragraph 1 – research and familiarization with available codes

Paragraph 2 – analysis of business activities and services offered

Paragraph 3 – consultation with tax professionals or accountants

Paragraph 4 – review of relevant tax regulations and guidelines

Paragraph 5 – updating the code as business activities evolve

Paragraph 6 – summary of steps to determine the correct code

Paragraph 7 – importance of maintaining accurate records

Advantages and Disadvantages of Using the Printing Business Code

Paragraph 1 – advantages and their explanations

Paragraph 2 – disadvantages and their explanations

Paragraph 3 – additional advantages and their explanations

Paragraph 4 – additional disadvantages and their explanations

Paragraph 5 – summary of pros and cons

Frequently Asked Questions (FAQs)

FAQ 1 – Question and answer

FAQ 2 – Question and answer

FAQ 3 – Question and answer

FAQ 4 – Question and answer

FAQ 5 – Question and answer

Conclusion

Paragraph 1 – recap of the importance of the printing business code

Paragraph 2 – reminder of potential consequences of incorrect usage

Paragraph 3 – encouragement to seek professional guidance if uncertain

Paragraph 4 – brief note on the evolving nature of tax regulations

Paragraph 5 – call-to-action for readers to ensure proper code usage

Final Remarks

Disclaimer: The information provided in this article is for general reference purposes only and should not be considered as professional tax advice. Always consult with a qualified tax professional or accountant for specific guidance tailored to your unique business situation.

Final Remarks paragraph 2

Final Remarks paragraph 3

Final Remarks paragraph 4

Final Remarks paragraph 5